2022 Overseas demand is hot China's PV exports continue to grow

Aug 17 , 2022Due to the mismatch of upstream and downstream production capacity in the PV supply chain, PV module prices are still at a high level compared to last year.

Benefiting from the energy transition of overseas governments and the solar hardware suppliers crisis caused by regional conflicts, the demand for PV products in overseas markets continues to grow.

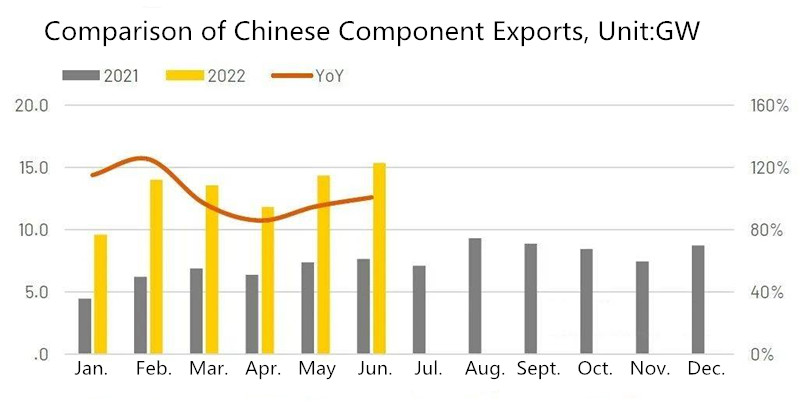

According to InfoLink's statistical analysis of China's customs export data, China's module exports reached 78.7GW in the first half of the year, a 102% increase compared to the same period last year, and nearly doubled month-over-month.

Regional Market Analysis

1.Europe

2.Asia Pacific

3.America

4.Middle East and Africa

5.Expected second half of 2022

1、Europe

Europe is the hottest market for imported solar panel mounting accessories in the first half of 2022, and has imported 42.4 GW of PV modules from China, with a year-on-year growth of 137%, and showing a month-on-month growth trend. At present, seven countries have imported more than 1GW of Chinese modules, including the Netherlands, Spain, Germany and other large markets.

Currently, the EU and some European governments have set more aggressive energy transition targets, such as the EU's REPowerEU Plan in May and Germany's new Renewable Energy Act (EEG), which have all raised PV installation targets. According to InfoLink's latest demand forecast, Europe's annual module demand will reach 55.6GW.

2. Asia Pacific

Asia Pacific region imported 17.2GW of Chinese modules cumulatively in the first half of the year, a 63% year-on-year growth. Compared to other regions, China's exports to the Asia Pacific market fluctuated more, mainly due to India's BCD tariffs of 40% and 25% on modules and cells respectively, which caused manufacturers to accelerate their shipments before the tariffs were imposed, resulting in 8.1GW of imports from India in Q1 and 8.3GW in the first half of the year. Japan and Australia, which have accumulated 3.2 and 2.7GW of Chinese modules.

InfoLink expects the Asia Pacific market, excluding China, to reach 38.3GW of module demand this year.

3. America

China exported a total of 12.1GW of modules to the Americas in the first half of the year, up 96% year-over-year. Imports of Chinese modules in the Americas are concentrated in a number of high demand countries other than the US, including Brazil, which currently has duty-free imports of PV products, with 9.0GW of module imports in the first half, and Chile, another major importer of Chinese modules, with 1.3GW of module imports.

The expected demand in the Americas is 46.0GW in 2022, except for the US, which is still imposing various tariffs on Chinese PV products due to the trade conflict, the rest of the Americas market still depends on Chinese module imports.

4.Middle East and Africa

The Middle East market imported 5.5GW of Chinese PV modules in the first half of the year, a year-on-year growth of 70%.

The Middle East market currently imports more than 1GW of countries including Pakistan and the United Arab Emirates, imports of 1.8, 1.0GW respectively.

The African region imported 1.6GW of modules, which is still small compared to other regional markets, but the year-on-year growth also came to 41%.

The demand for modules in the Middle East and Africa is estimated to be 12.4 and 3.8GW in 2022.

5.Looking to the second half of 2022

In addition to the first half of the year in Europe, where demand for imported modules may have cooled due to early stocking by solar racking system manufacturers in Europe, other regional markets have the opportunity to further stimulate exports of Chinese modules, making Chinese module exports expected to surpass the first half of the year.

InfoLink estimates that the global demand for non-Chinese modules in 2022 will be 156.1 - 185.3GW, with a growth rate of 20 - 42%.

Source: PVInfoLink